What Is a Company’s Intrinsic Value? (Pt 2)

This is the second part of an article about intrinsic valuation. Here is part 1 and part 3.

Calculating the Discount Rate

The fact that mature companies grow at a steady rate gives us a way to calculate the discount rate without depending on guesses as to the return of an equally risky investment. We know that the present value of an investment that pays dividends in perpetuity with a constant growth rate equals its dividend divided by the difference between the discount rate and the growth rate. So let’s take all mature companies—companies with fourteen or more years of annual reports—and find out what they’re actually returning to shareholders (shareholder payout). Then we’ll take that as a percentage of these companies’ total market cap (shareholder yield).

The conventional calculation of shareholder yield is the sum of dividends paid, net equity purchased, and debt reduced, all divided by market cap. Including debt reduction is quite problematic, as debt has significant tax benefits and its cost is far lower than the cost of equity, so mature companies very often increase their debt rather than reduce it. Therefore, despite the Modigliani-Miller theorem that capital structure is irrelevant to value, I’m going to include only dividends paid and net equity purchased.

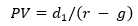

Now we can add shareholder yield to these companies’ total sales growth and thus find out what the discount rate will be. If you don’t follow my logic, here are the equations: v = d/(r – g), where v is value, d is payout, r is discount rate, and g is growth. Solving for r gives you d/v + g: shareholder yield plus growth.

Let’s look at shareholder yield first. I calculate forward shareholder yield by taking the shareholder payout as defined above and dividing it by the market cap at the beginning of the payout period. Since January 1, 1999, this has averaged 3.58% (using a cap-weighted average). However, between 1999 and 2006 it averaged only 2.80% while between 2012 and today it has averaged 4.43%.

Annual sales growth, on the other hand, has the opposite trajectory. Its overall average is 5.84% (again cap-weighted), but its average between 1999 and 2006 is 8.50% while its average between 2012 and today is only 3.37%.

If you add the two together and subtract the risk-free rate (the rate of ten-year US treasury notes), you get a series with plenty of peaks and dips, but one that hasn’t significantly declined or increased this century. This is called the equity risk premium, and it has an average of 5.99% overall.

So we can say that the discount rate should be 6% plus the US ten-year treasury rate. Consider that the treasury rate has averaged 3.44% over this period, and then consider that the total market cap of these companies has increased by 9.62% per year (compounded). It all adds up beautifully. Our discount rate so far this century has averaged 9.43%.

I also thought that one could specify discount rates for specific sectors. But when I tried this, only three sectors had implied discount rates that were more than 10% different from the average (energy, health care, and utilities, all of which were higher than average, most likely because health-care companies grow more and energy and utility companies pay large dividends). Because the implied discount rate varies a great deal from year to year, the difference between sectors is far, far lower than the difference between years. And all three of these sectors face enormous uncertainties in the years ahead as our health-care system and energy use change. So I would conclude that using an overall discount rate of 6% plus the risk-free rate is likely wiser than using sector-specific rates.

(If you’re a Portfolio123 member and want to know how I calculated the discount rate, I created a universe of all stocks that have reported annually for fourteen years or more, have a market cap of $30 million or more, and sell at a per share price of $1 or more. I then took the sum of dividends paid and equity purchased of all these companies over the past year and subtracted the sum of equity issued. I then divided this by the total market cap of all these companies at the beginning of the fiscal year I was measuring. I now had aggregate shareholder yield. To this I added the total sales of all these companies divided by the total sales last year of all these companies and subtracted one to get the aggregate sales growth. I plotted this since 1999, downloaded the chart results, and took the average. I relied primarily on FactSet data, but checked Compustat data as well.)

Should Risky Companies Get a Higher Discount Rate?

Some people think that the discount rate should reflect the risk being taken. Investing in a tech stock is riskier than investing in a utility, so the discount rate should be higher.

Let’s play with this notion a little. Let’s take two companies, a utility and a tech company, with the same shareholder payout and the same growth rate. Let’s say they both pay about $300 million to shareholders and have a growth rate of about 4%, and both are mature companies.

If we assign an 11% discount rate to the tech company and a 7% discount rate to the utility, we come up with an intrinsic value of $10 billion for the utility and $4.3 billion for the tech company. Does this really make sense?

I decided to test this. I divided my universe of mature companies into two groups: those with a five-year beta greater than one, and those with a five-year beta less than one. But the stocks with a higher beta got a lower discount rate. In general, high-beta stocks seem to be paying less and growing less than stocks with low betas, though there are time periods in which the opposite is the case. The difference between them is small, but not insignificant. I also tested a more extreme version: stocks with a beta less than 0.8 versus stocks with a beta greater than 1.2. The results were even more extreme: low-beta stocks deserved a discount rate almost 2% higher than high-beta stocks.

When you think it through, high risk does not equal high reward. Yes, risk and reward are correlated up to a certain point, but beyond that point, the higher the risk, the lower the reward. You can read more about this here.

Finding the Right Variables

Now in performing the above exercise, I used revenue growth and shareholder yield as my proxies for g and d in the formula

But what if we use EPS or EBITDA growth for g? What if we use free cash flow or net income for d? Wouldn’t the discount rate change significantly? Perhaps.

But when trying to calculate the discount rate, I think it’s safest to be conservative. Revenue growth is the most conservative measure of growth. It doesn’t jump around nearly as much as other measures. The same holds true for shareholder yield. These numbers are not nearly as subject to accounting tricks as the others. There are probably twenty different ways to measure free cash flow, and companies regularly report earnings and EBITDA numbers that differ significantly from those mandated by generally accepted accounting principles (GAAP). In addition, some people think R&D expenses should be capitalized, and others don’t, which will seriously affect earnings and EBITDA figures. Sticking to revenue and shareholder payout brushes all that aside.

Cash generated by profits, or free cash flow, can pay down debt, generate growth, be returned to shareholders, increase executive compensation, be invested outside the company, or just sit there. If a company generates growth or returns the cash to shareholders, that will show up in this conservative exercise. When a company chooses one of the other options, why should that affect its return to shareholders—and therefore its intrinsic value? If a company puts all its profits into paying down its debt, that will not benefit shareholders unless it’s in danger of bankruptcy. If the market sees that a company’s profits are squandered on executive compensation rather than fueling growth or being returned to shareholders, it will not place a premium on that company’s stock.

What I’m saying is that we really can boil down a mature company’s intrinsic value to two basic things: shareholder payout and revenue growth. Everything else—profitability, return on capital, earnings growth, free cash flow generation, asset turnover, accruals, and so on—are simply the steps between those two. All of them, of course, have to be in place before revenue growth can be successfully converted into shareholder payout, and some of them figure a great deal in how a company converts its assets into sales growth. They are indispensable figures and should never be ignored. But the basics of valuation lie in those two items.

Predicting Shareholder Payout

I compared shareholder payout in one year to the previous year’s possible indicators of shareholder payout. By far the best predictor was the previous year’s shareholder payout, which is exactly what one might have guessed. Surprisingly, however, free cash flow was an extremely poor predictor of shareholder payout. After the previous year’s shareholder payout, the best predictors I found were, in order of best fit, operating income (EBIT), EBITDA, operating cash flow, old-fashioned cash flow (after-tax income plus depreciation and amortization minus preferred dividends), net income, and gross profit. Because EBITDA and old-fashioned cash flow are very highly correlated with (in other words, very similar to) operating income but inferior in fit, we can eliminate those, leaving us with five significant data points in predicting shareholder payout. Performing multiple regression after trimming outliers can give us a formula, which I’ll provide at the end of the third part of this article.

This formula, like all the formulas in this article, will give you a very rough estimate, and should not be used widely, especially when trying to establish an intrinsic value for a particular company. Instead, it’s a nice basis for doing some wider data analysis. The key point is that in calculating future shareholder yield, past shareholder yield should not be your only data point. You also need to take into account income (before and after taxes), cash flow, and perhaps even gross profit.

This in turn can give us some insight into what will be useful for estimating the intrinsic value of immature companies: their ability to convert revenue not only into shareholder payout but also into income and cash flow.

Predicting Sales Growth

I’ve already discussed this at length, giving a number of factors to take into account. I came up with a different formula based on multiple regression and winsorizing outliers that avoids ranking. It takes into account price momentum, analyst estimates of next-twelve-month sales growth, asset growth, the ratio of net operating assets to total assets, the median sales growth over the last five years, and analyst recommendations. (The actual formula is at the end of the third part of this article.) By this formula, Apple’s (AAPL) projected sales growth is 14%, Microsoft’s (MSFT) is 13%, Amazon’s (AMZN) is 25%, Google’s (GOOGL) is 15%, Facebook’s (FB) is 19%, and WalMart’s (WMT) is 3%.

Once again, this is a very, very rough calculation, and should be used for overall data purposes rather than figuring out the sales growth of a particular company. The key takeaway is that in calculating future sales growth, one needs to look at a wide variety of factors, not only past sales growth.

Final Part

In the last part of this article, I’ll conclude my analysis of intrinsic value, give an example of how to calculate it, share some formulas, include a performance evaluation, and offer some general conclusions.