Change Partners: Some Thoughts on Market Regimes

Two Kinds of “Market Regimes”

A lot of investors talk about “market regimes.”

This term can have several different meanings. Classically, a market regime is characterized primarily by four measures: interest rates, inflation, GDP growth, and unemployment; often added to these are characterizations of government fiscal and monetary policy. But one can also talk about a market regime in terms of which stock factors work and which don’t.

For example, in terms of the economy, the last five years was a period characterized by low interest rates, low inflation, low GDP growth, and low unemployment (this last item has just changed dramatically). In terms of the stock market, the period can be characterized by large caps outperforming small caps, expensive stocks outperforming cheap stocks, momentum outperforming reversion, and low volatility outperforming high volatility.

There was, in fact, another period in which all this was true: 2007. And then there have been periods in which the reverse of all these was the case: in 1991, for instance, inflation, interest rates, and unemployment were all high (though GDP growth wasn’t), small caps and cheap stocks did well, and momentum and low-volatility strategies underperformed, while the same could be said of 1982 except for the momentum part.

Many investors have devoted a lot of energy into identifying what market regime is coming next—or what market regime we’re currently in—and allocating their assets accordingly. But to what extent do the various components of a “market regime” actually go together? If we were to characterize time periods based on these four economic indicators and these four stock factors would we find any consistency?

I decided to test this looking at stock returns from the last 57 years, from 1963 to today, relying on Kenneth French’s library for factor returns and on Federal Reserve Economic Data. But before I look at regimes, I thought it would be important to look at correlation. I threw in one extra factor for good measure here: profitability, as measured by operating ROE.

The Correlation of Components of Market Regimes

First, here was my method. Following French, I looked at the five factors and measured the difference in monthly returns between the top and bottom quintile for US stocks on the major exchanges. (I followed French’s lead in choosing which was top and which was bottom; his preference for small over big, however, should be up for debate.) For the value factor I used earnings yield; for momentum I used the returns from the twelfth month to the month before measurement; and for volatility I used the variance of daily price returns. For the economic indicators, I used CPI year-by-year growth for inflation, ten-year treasury yields for interest rates, percent change in GDP for GDP growth, and the unemployment rate. I understand that other investors might choose different indicators, and I make no claims as to the superiority of my choices. I chose these indicators because they struck me as simple and sensible.

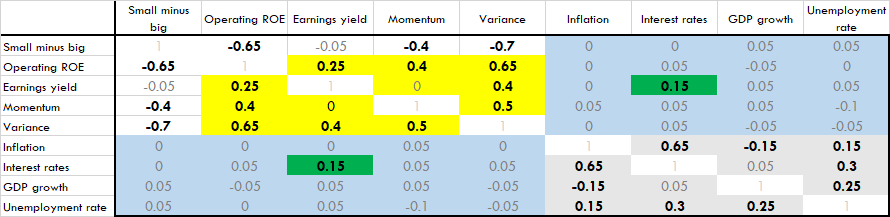

I then created a correlation table:

The economic indicators (see gray-shaded area at bottom right) correlate with each other to some degree. So do the stock factors with the exception of size (see the yellow-shaded area in the middle; size, if measured as small minus big, correlates negatively with most of the other stock factors). The only pair of those four non-size factors that exhibits no correlation is momentum and earnings yield. The only stock factor that seems to correlate well with an economic indicator is earnings yield, which correlates with interest rates.

Let’s look closely at these correlations.

- Value outperforms when interest rates are high. Why? If you classify industries by their aggregate earnings yields, financial companies are usually right near the top. And financial companies benefit from high interest rates.

- Momentum, low-volatily, high ROE, and large stocks all outperform together. As I have shown, momentum is a proxy for high quality, growth, and good management while low volatility is a proxy for stability in stock fundamentals. High ROE depends on solid earnings. In general, large caps are more likely to excel in these areas than small caps, which are often highly speculative, without solid earnings, with unstable fundamentals, and with a larger probability of bankruptcy.

- There’s no correlation between size and earnings yield. On the one hand, you would think that smaller companies were more likely to be “mispriced.” On the other hand, smaller companies are more likely to have negative earnings than large ones. This probably explains the lack of correlation.

- There’s no correlation between momentum and earnings yield. You might expect a negative correlation, since value investors like to buy stocks near the bottom and momentum investors like to buy stocks near the top. But in fact, value and momentum both outperforming is just as likely as only one outperforming.

- There’s a very strong correlation between inflation and interest rates. This is due to what economists call “the Fisher Effect.” Remember that interest rates are unadjusted for inflation. So interest rates are equal to inflation plus a risk premium (essentially 0% for US treasuries) plus the “real rate of interest.” Since the “real rate of interest” doesn’t vary as much as inflation does, the correlation between the actual rate of interest and inflation is quite strong.

- The unemployment rate correlates with the other economic indicators. This seems counterintuitive. If you ever learned about the “Phillips curve” in your economics classes, you remember that inflation and unemployment are supposed to be inversely correlated. And high GDP growth is supposed to lead to lower unemployment. But time has not been kind to the “Phillips curve”—it was essentially rendered unusable by “stagflation” in the 1970s. Since then, we’ve experienced a number of periods of low unemployment, low growth, low interest rates, and low inflation (like the last five years) and a number of periods of high levels of all of these (look at 1975 to 1988).

- GDP growth and inflation are negatively correlated. The explanation for this is simple: GDP is already adjusted for inflation. GDP growth is calculated by taking actual GDP growth and subtracting the inflation rate. Any time you subtract a number, the correlation between the result and the subtracted number is going to be negative.

- There is little to no correlation between stock factors and economic indicators. See the blue-shaded areas. The only exception is discussed above in point #1.

57 Years of Market Regimes

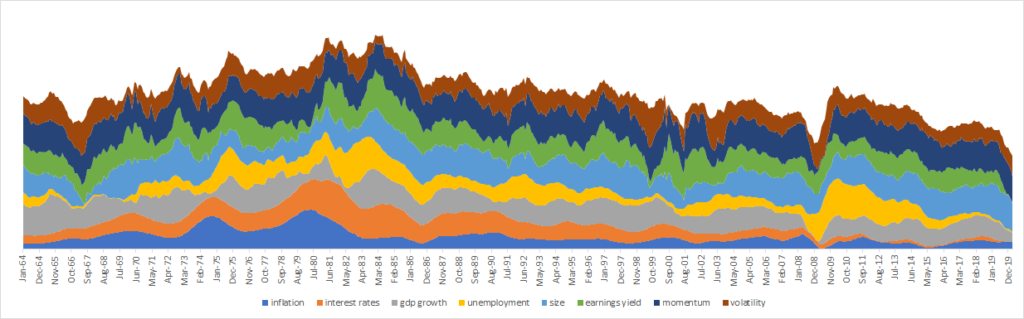

I’ve divided the last 57 years into economic regimes according to the four standard macroeconomic indicators and the four stock factors I discussed above. I smoothed the results by taking the average each month of the six months before and after it. In the first chart, I rated measures from high to low based on the maximum and minimum average values. In the second I did the same for the economic measures but the stock factors depend on whether the top or bottom quintile dominated. I changed two things from my discussion in the previous section: size is now big over small and volatility is now high over low; the other way around was counterintuitive when looking at charts that show high and low.

The following charts indicate the results.

In the top chart, the thickness of the graph indicates how high the indicator is. So, for example, at the beginning of 2020, at the right of the chart, all four economic indicators were very low (interest rates, inflation, GDP growth, and unemployment). The size factor is very thick because large stocks dominated over small ones; momentum is pretty thick too. Volatility is medium to thin (low volatility stocks outperformed high volatility ones) and earnings yield has thinned down to nothing (stocks with low earnings yield dominated those with high earnings yield).

The second chart simplifies everything into high and low. Once again, in early 2020, all four economic indicators were low (see the bottom four colored bars). The only things that were high were size (large stocks dominated) and momentum.

Looking at these two charts one can break down time periods into various market regimes. The major question is: is there any consistency? In other words, if we look at two widely separated time periods with the same economic conditions, do the same factors work?

Not really.

Let’s look, for example, at periods during which all four economic indicators were high and periods in which they were all low. The former were 1976 to 1978 and 1983 to 1988. The latter were 2001, 2007, and 2015 to early 2020.

During the 1976 to 1978 period, small stocks with high earnings yield, momentum, and volatility outperformed. During the 1983 to 1988 period, large stocks with high earnings yield and momentum but with low volatility outperformed. So there’s no real consistency there.

In 2001, small caps with high momentum, low volatility, and high earnings yield outperformed. But in 2007 and in 2015 to today, large caps with high momentum, low volatility, and low earnings yield outperformed. Again, there’s not much consistency here.

What if we just look at stock factors? Is there any consistency there?

There doesn’t seem to be. Momentum has usually worked pretty well—there are few periods in which it hasn’t. But, as I pointed out earlier, size and earnings yield are completely uncorrelated. There are very few periods in which all these factors are consistent with each other.

The next question to ask is whether there’s any cyclicity to these regimes. Is one regime more likely to follow another?

Unfortunately not. There seems to be absolutely no pattern to these regimes.

Where Are We Now?

We seem to be moving into a period characterized by low interest rates, low inflation, low growth, and high unemployment. This makes it similar to the 2009 to 2015 period. But there haven’t been any other periods with this combination in the last 57 years. Perhaps, like in 2009 to 2015, all four of the stock factors will shift around, sometimes outperforming and sometimes not. That would be a definite change from the last five years.

It’s also quite possible that inflation will go up due to massive government debt. If inflation and unemployment are both high but interest rates and growth remain low, we’ll be in a relatively unprecedented situation. The only period in the past 57 years characterized by this combination of indicators was a short period in late 2011 and early 2012.

Concluding Thoughts

There are many other ways to approach market regimes. Some people use price-to-book ratios rather than earnings yield, for instance, and there are other ways to measure momentum and volatility. With the macroeconomic factors one could test second-order factors, e.g. the rise in unemployment or the change in interest rates.

But I don’t see anything very actionable here. There have been several times when all four stock factors have reversed course—in 1969, 1975, 1991, 2008, and 2010. Is that likely to happen now? I have no idea.

On March 12, the day after the Dow Jones exited the bull market, my colleague Marc Gerstein said (on a forum thread on Portfolio123) that it was time to abandon everything you knew and figure out what the next regime was going to be. “Disinflation, such a pronounced feature of the economy since 1982 that people hardly even talk about it, may be dead for a generation or so. . . . The Fed is done. It has no ammo. No more weapons. The accelerator has been floored and the engine is flooded. . . . When I started in this business, a P/E of 8 or so was considered pretty respectable and 12 to 15 was nosebleed territory. Expect valuations to eventually start a long multi-year and possibly multi-decade march back in that direction. That may get to 180-degrees opposite of the world that [we have] lived in since [the early 2000s].”

Marc’s comment makes sense. Regime change is happening. Whether he was right about disinflation and the Fed and P/E remains to be seen. The regime that just ended lasted longer than most (though there’s an exception: the 1983-1989 regime lasted longer), and the pandemic and the government response to it have brought fundamental changes to the economy.

I have no faith in my own ability to prognosticate, I’m afraid. I lack Marc’s confidence, conviction, and insight. Instead, I have slowly adapted my own stock-picking strategy to keep up with the fact that value stocks have been underperforming, and I have been trying to focus on what has worked on Wall Street over the past ten to twelve years rather than what worked in other time periods. With the coming regime change, I may be caught flatfooted.

But at least I can say this: the regime that just ended has been very good to me, despite the fact that I’ve been investing in cheap microcaps while the regime has favored expensive megacaps. That regime allowed me to grow my portfolio by about 30% a year. Will the next? Only time will tell.

As the person quoted toward the end of the article, I need to point out that it was a few months ago, and that given the pace at which the world has been moving, a few months is a long time. While I still adhere to much of what I said back then, it does look like the onset of re-inflation is being pushed back — at least as thing appear now.

The bigger issue though is the treatment of the topic of regimes. The perspective is way way way too narrow and that may ave something to do with the author’s statement that he lacks my “confidence, conviction, and insight.”

Regimes are not about factor, indicators or whatever. They are about the characteristics of the real (non mathematical) world that cause the factors and indicators to behave as they do. They are about history, politics, society, culture, etc. Unless you understand what’s happening in these terms and recognize how they influence markets, you have no hope whatsoever of understanding market “regimes.” Although “quants” like to play around with regimes, that doesn’t mean their work is worthwhile or even prudent. I once tried to check out this angle but abandoned it when I quickly saw that the entire task — quantification of regimes — was nonsense. Children like to play with fire but sometimes, one has to be taught that one should be careful playing with things that can hurt them if misused.

If you want to understand regimes, close your spreadsheets, turn off your computer, and study up on socio-political-economic history of the last 150-or-so years. Notice the ebb and flow of the interaction between the different strata of society and work to identify where we’ve been recently, where we are now, and where we seem to be headed. Factor in today’s Black Lives Matter protests, which now are playing a role similar to what the Civil Rights/anti Vietnam War protests played some decades ago and how this pushes regime shift.