How to Profitably Hedge with Put Options

At the beginning of 2022 I hit on a better way than going short to hedge my long positions: buying cheap put options on stocks I expected to tank. Following this strategy was very profitable at first, since 2022 and 2023 presented an ideal market for it.

The strategy isn’t as complicated as most options strategies. I buy low-priced medium-range out-of-the-money puts on a select group of stocks that I deem worthless. I then hold them until the week prior to expiration, with a few minor exceptions.

In this article I’m going to

- explain why hedging with put options is preferable to hedging with short positions;

- explain what put options are and how they work;

- take you through my process of choosing put options to buy;

- give you some tips on portfolio management with a put-option hedge.

- Why Not Short?

- Why Puts Are Not a Good Stand-Alone Strategy

- How I Came Up With This Idea

- The Costs of Put Options and Short Positions

- What Are Put Options?

- The Relationship Between the Price Change of the Underlying and the Value of the Option

- Selecting Stocks Primed to Fail

- Pricing and Holding Period

- How to Buy and Sell Puts

- Managing a Put-Option Hedge

- Stocks I’ve Hedged and Puts I Own

- Returns of the Put-Option Hedge

Why Not Short?

When you short a stock, you borrow shares (sell short) and then close your deal by buying them back (buy to cover). If the price has fallen 50%, you gain 50%; if the price falls 85%, you gain 85%. But if the price rises by 80%, you lose 80%; if the price rises by 250%, you lose 250%. The most you can gain from a short position is 100%. But you can lose an infinite amount of money.

This tremendous imbalance between downside and upside has always prevented me from implementing a short strategy. I have, over the last eight years, repeatedly tried to come up with a short strategy that, when backtested, would not only provide a hedge but also increase my returns. I have, over those years, repeatedly failed to do so.

When you buy a put option, you are placing a bet on a stock’s price. If the price falls more than a certain amount, you’ll break even; if the price falls farther than that, your return will be a rough multiple of what you paid. If a stock’s price falls to close to zero, you could make a return of 1,000% or more. If the stock’s price does not go down to the strike price, then your option will expire worthless and you’ll lose the entirety of your investment. So your gain is unlimited and your loss is limited to 100%.

Why Puts Are Not a Good Stand-Alone Strategy

2022 and 2023 were a favorable environment for puts. First, there was a full-fledged bear market, during which stock prices fell. Then, during the recovery, volatility decreased quite a lot. When volatility is low, options are cheap.

However, I’ve identified other recent two-year periods during which my put strategy would be a complete failure, with a probable loss of 100%.

In addition, put options are extremely volatile instruments, and they are often correlated with each other. The value of my put portfolio can easily drop by 15% in a day and by 80% in a month.

So I view puts as a hedge, not a stand-alone strategy.

The purpose of hedges is to reduce volatility. In my backtesting, put options have served this purpose very well. It’s especially important to have an effective hedge if you’re using leverage. In the hedge fund I’m managing, I’m employing both leverage and a put-option hedge. The combination should allow me to increase returns while reducing market risk.

How I Came Up With This Idea

In 2021 I read Jim Cramer’s Real Money. Despite what Cramer has since become, it’s not a bad book; it was written almost twenty years ago. In it, Cramer writes, “please use puts when you can instead of borrowing and selling short stock. . . . If you are sure something is going to go down but don’t know when, use deep puts going out many, many months. You will never regret paying the extra money.”

Cramer’s entire chapter on options, “Advanced Strategies for Speculators,” is well worth a read, even twenty years later.

The Costs of Put Options and Short Positions

When you short a stock you often pay a borrowing cost. This is a daily percentage of your outlay. Borrowing costs will vary wildly from stock to stock and from broker to broker. With some brokers (e.g. Fidelity), there is no borrowing cost for most stocks; others (e.g. Interactive Brokers) charge for every stock. The borrowing cost depends on how many shares are available to short. So very popular shorts will be far more expensive than unpopular ones. I’ve often seen borrowing costs that are more than 100% a year.

With put options, you pay a substantial commission in addition to the price of the option. In addition, puts can be extremely expensive. Just like shorts, the more popular a put option is, the higher its price will be. It’s also far more complicated to determine a good price for a put option than it is for a short position. Lastly, the bid-ask spreads for put options are far, far wider than those for short positions. For the kinds of stocks I buy options on, the spread will often be 25% of the midpoint.

Shorting stocks is quite expensive, but not as expensive as trading puts. One reason that people prefer shorting to buying put options is that the costs of put options are so high. Another is that it’s a lot easier to buy and sell short than it is to trade in options. I probably spend three times as many hours investing in puts as I would investing in shorts.

Put options have other disadvantages over shorts. You can choose how long to hold a short position, and you don’t have to tie it to a specific price. Put options, on the other hand, expire on a certain date, and while you can exercise them early if you’re in the money and roll them over if you don’t mind paying large commissions, they’re far less flexible.

So if you choose to hedge with put options, it’s extremely important to calculate how much you’re willing to pay, to take commissions into account, and to use limit orders only.

What Are Put Options?

Option markets have been around for hundreds of years; some even date them to ancient Greece. The market for them was developed in the late 1800s by an American entrepreneur named Russell Sage. But it wasn’t until 1973, with the birth of the Chicago Board of Options Exchange (CBOE) and the Options Clearing Corporation, that trading options became standardized and safe. Even then, only call options, most of them relatively illiquid, were available. In 1977, put options were introduced to the CBOE, and liquidity was far better than before. Since then, the growth in options trading has been exponential.

A put option consists of four elements. First, there’s the underlying stock. Second, there’s the strike price: the price which you’ll get for the stock if you’re holding it upon expiration. Third, there’s the expiration date, which is usually the third Friday of a particular month. Fourth, there’s the premium, which is the price you pay for the option.

A few other terms are important. If the current price of the stock is above a put’s strike price, the option is out-of-the-money; if it’s under the strike price, it’s in-the-money. If the expiration date is more than a year from now, it’s a long-term option; if it’s in the next month, it’s short-term; if it’s in-between, it’s a medium-term option. Lastly, an option is always for 100 shares, so a $2.00 option costs $200.

I’ll illustrate how put options work. Let’s say I want to bet against Rivian Automotive (RIVN). The stock is trading at $10.88. I buy 50 December $10.00 RIVN puts for $1.95 apiece. What does that mean?

That means that if I own 5,000 shares of RIVN and the price is less than $10.00, I can sell each of my shares for $10.00 on any date prior to and including December 20 (each option gives you the right to sell 100 shares). If, on the other hand, I’m holding my puts on December 20 and the price of RIVN is greater than $10.00, my options expire worthless.

Essentially, I am betting $1.95 that the price of RIVN will be below $10.00, and my return on that $1.95 is the difference between $10.00 and the price of RIVN. So if the price falls to $8.05 ($10.00 – $1.95), I break even (ignoring commissions), since I’m able to sell my puts for $1.95 or buy the underlying for $8.05 and exercise the puts for $10.00. If the price falls below that, I begin to make money.

The Relationship Between the Price Change of the Underlying and the Value of the Option

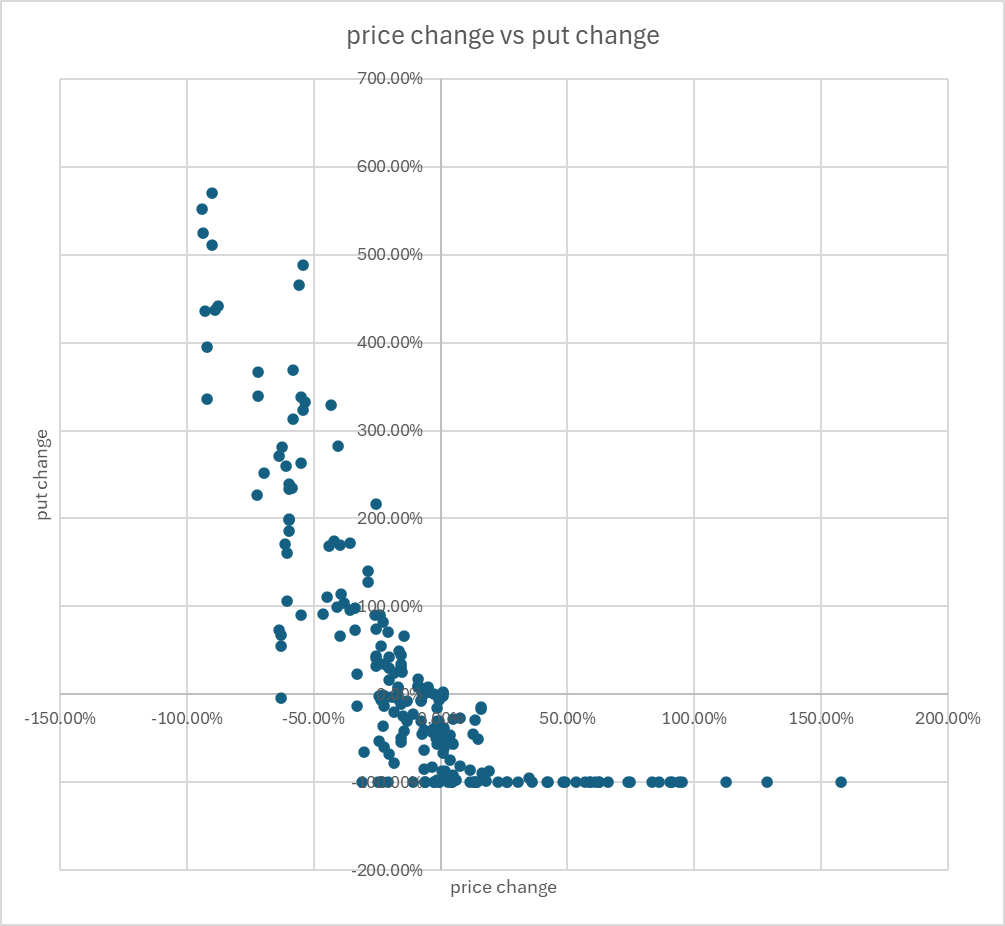

As you can see from the foregoing, as a stock’s price falls, the value of the option rises. Below is a chart of my realized returns on the options I’ve bought and sold or exercised against the rise or fall in price of the underlying during the period I’ve held the option.

As you can see, if you use my strategy, you’re unlikely to make any money on puts unless the price of the underlying falls by more than 20%. If the price rises, you’re likely to lose your entire investment. 58% of my puts have lost money, and 22% have expired worthless (a 100% loss). Given that, it seems improbable at first glance that you’d be able to make any money using this strategy.

But those losses are compensated for by the wins, which have at times exceeded 500%. All in all, my average gain was 31%. Now consider my average holding period was 122 days. Annualized, if I’d invested equally in each of these puts, I would have made (1 + 31%)365/122 – 1 = 142%.

Here’s a rough formula summarizing the relationship of price change to put change. If the price change is x and the put change is y and the holding period is 17 to 18 weeks, y = max (–1, –4.75x – 0.55). A slightly less rough formula is y = max (–1, 3.23x2 – 2.7x – 0.51) for x < 40%; for x ≥ 40%, y = –1.

Selecting Stocks Primed to Fail

I use multifactor ranking systems at Portfolio123 for stock picking, whether I’m going long or buying puts. But the factors I concentrate on are quite different. At the moment, I’m looking for puts on stocks with the following characteristics:

- Frequent reductions in earnings over the last few years.

- A ratio of taxes paid to market cap that’s far lower than that of similar companies.

- Unstable sales.

- Poor price momentum over the last nine or ten months (not considering the most recent month).

- Poor subsector or industry group momentum.

- Low asset turnover.

- Low institutional ownership.

- A wide dispersion in analyst estimates.

- Asset instability (lots of big changes over the last few years).

- A recent very unpleasant earnings surprise.

- If the ratio of gross plant to sales is both wildly different from what it’s been for the last few years and wildly different from the industry norm, that’s a good sign that something’s amiss.

- Stocks in industries particularly susceptible to factor-based assessment: capital goods; consumer goods, retail, and services; energy; entertainment; health-care equipment and services; household products and services; industrial services; IT services; software; staples retail.

- Dividend-paying companies who clearly can’t afford to pay dividends. If the sum of net income, preferred and non-preferred dividends, and special items is less than zero, they’re in trouble.

- Low intangible-adjusted EBITDA to assets.

- A major increase in investment (gross plant + inventory) compared to total assets; also if there’s been a lot of instability in this ratio over the last twelve quarters, that’s a good sign.

- High price volatility.

- High accruals.

- Unstable ROA.

- Enormous increases or decreases in cash.

I’m looking at lots of other factors too, but those are a few of the ones that stand out right now.

Pricing and Holding Period

There are five factors that go into determining a fair price to pay for an option.

- The current price of the underlying stock.

- The strike price.

- The expiration date.

- The volatility of the stock.

- The risk-free interest rate.

There are two widely established formulas for determining the fair price of an option based on these five inputs. Personally, I don’t use either one. But they’re important and good to know. You can skip the following paragraphs if you feel like they’re too far into the weeds. Pick up again at the paragraph beginning “There’s one other fair-price value.”

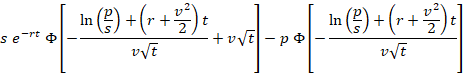

The first of these formulas is the Black-Scholes formula. Let’s call the strike price s, the current price p, the years to expiration t, the volatility v, and the risk-free interest rate r. Then the Black-Scholes price for a put is

where Φ is the normal cumulative distribution function.

(It’s important to note how volatility is measured for these formulas. You take the standard deviation of percentage moves in daily price over a certain period, and then multiply that by the square root of 252, since there are approximately 252 trading days in a year. I have found that another indicator of volatility is equally good: the median ratio of the high-low difference to the closing price; again, one has to adjust this so that it approximates the annual volatility. To do so I multiply it by 1375.)

The Black-Scholes formula is quite complex, but at least you can fit it into a line or two in an Excel file. The formula for the binomial price, on the other hand, requires an entire Excel sheet to compute and an explanation of how to do so would be excessive for this article.

There’s one other fair-price value that’s essential, and that’s the intrinsic value. That one is easy to calculate. If the stock’s price is less than the strike price, the intrinsic value is simply the strike price minus the stock price. If it’s more, then the intrinsic value is $0. The intrinsic value is the amount of money you would get if you were to buy the stock and then exercise the option. If the intrinsic value is greater than what you paid for the option, you’ve made a profit.

Now what do I consider a fair price for an option?

For me, both the Black-Scholes and the binomial prices are usually too expensive. The only exception is when t is greater than five or six months and v is relatively low compared to the other stocks I’ve identified as good bets for puts. For such stocks I’ll consider paying a little more than the Black-Scholes or binomial price.

Now you don’t see Black-Scholes or binomial prices in most options screens. Instead you get an indication of the Black-Scholes price by looking at the implied volatility of the stock. Implied volatility is the v in the above formula given a certain price.

I use a complicated spreadsheet to calculate the price I’m willing to pay for an option. And while it’s complicated, it’s also deliberately naïve in that it doesn’t take into account any of the Greeks or other conventional measures most people use in options pricing.

One can extrapolate the future price change of a stock in terms of probabilities based on the stock’s historical volatility and the amount of time that elapses. For a given stock, there’s an X% chance that its price will increase (or decrease) by Y% by time T given its volatility V between now and time T. Because of mean reversion, the stock’s implied volatility V is going to be different from its historical volatility; we also should take into account that the overall market’s volatility is going to be a factor that we have no way of predicting.

Because of this I use only three inputs in determining the price I’m willing to pay for an option: the expiration date, the relationship of the strike price to the current price, and the relationship of the stock’s historical volatility to that of other stocks that I favor for puts. I assume that a stock’s future volatility will be roughly the average of its historical volatility and the average volatility of those stocks.

My spreadsheet takes these inputs and then calculates the amount of money I will make if the option is priced at $0.05, $0.10, $0.15, and so on, given a range of fifty different possibilities for the stock’s price.

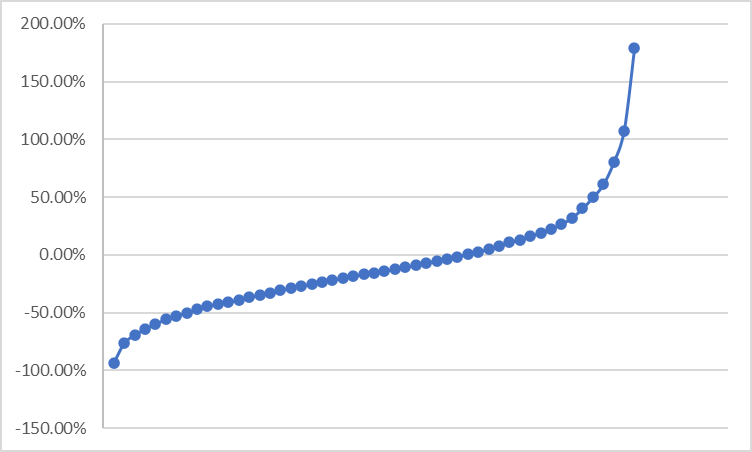

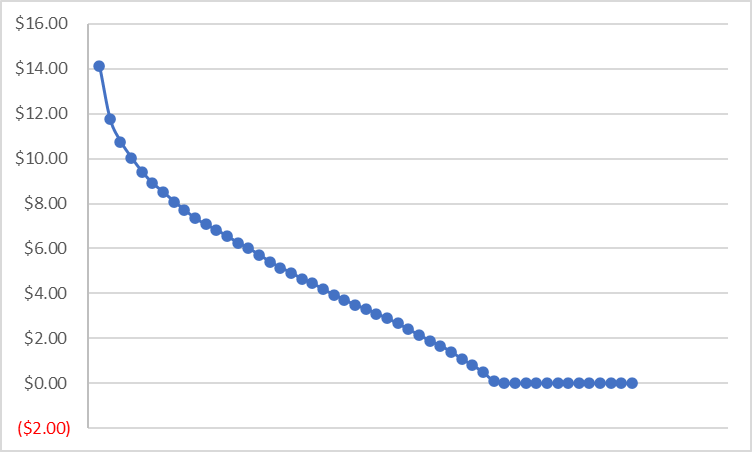

Let’s use a concrete example. I have an option on a stock priced at $16.28 with an expiration date 199 days hence and a strike price of $15.00. Its historical volatility is 67.3% and the volatility of similar stocks is 72.33%.

Here’s a graph of the stock’s probabilities between now and expiration, with each dot representing a 2% chance.

Corresponding to that, here’s a graph of the value of the option contract at the time of expiration.

I can then use these figures to calculate what my returns might be if I bet on this option fifty times, spending a nickel on each bet. Obviously, with a bet that cheap, you’re going to have astronomical returns if the contract ends up being worth $2.00 or more. With a bet of $3.00, however, your losses would far outweigh your gains. My spreadsheet calculates the profit or loss for each bet and then settles on the highest price that would probabilistically justify me putting a certain percentage of my money into the option. (In this case, it’s $2.50.)

Based on this spreadsheet, I calculated that out-of-the-money options were more worth my while than investing in in-the-money options; that options with expiration dates in the next two or three months were impossible to find cheaply enough; and that options with expiration dates more than nine months away were too unpredictable to be worth considering. This narrows down my field of put options considerably.

How to Buy and Sell Puts

Given the low prices I demand for put options, they’re very hard to find. But I do have a trick up my sleeve: GTC (good-til-canceled) orders. Because the prices of the underlying stocks are usually extremely volatile, if I place a GTC order at a price significantly lower than the ask, it’ll often get filled later when the stock’s price has a temporary spike. I usually keep my orders on for about a week.

If a stock’s rank goes down quite significantly between the time I buy the stock and the expiration date, I may choose to sell it early. I only do so if the stock’s price is relatively close to or under the strike price. Again, I’ll use GTC orders to maximize my chances of getting filled at a decent price.

It can be quite expensive in the short term to exercise put options, because you have to buy the underlying stocks and wait a day for the trade to clear. So you’re temporarily out of pocket a huge multiple of what you’ll get when you exercise. On the other hand, it’s by far the safest method of profiting from an in-the-money put that is about to expire. Once you own the underlying, it doesn’t matter if the price goes up past the strike and renders the put option worthless. In that case, if you can’t get the strike price for the shares you own, you can sell them for even more.

Managing a Put-Option Hedge

A well-diversified portfolio of underlying stocks is a good idea: I would suggest a minimum of a dozen. It’s also very important to diversify your expiration dates. Both of these will reduce the chances of your hedge going to zero in unfavorable market conditions. I try to buy puts on each of my underlying stocks with at least two different expiration dates. It’s also good to diversify your strike prices on each underlying, but that’s much less important.

I think one should decrease and increase one’s hedge based on the market. If horrible stocks have been doing extremely well lately, it may not be a good time to buy or hold put options. You especially want to watch out for market rebounds after a significant fall, or major contractions in the yield spread once it’s been high (these two usually coincide). All of this is very difficult to predict, of course, and transaction costs of decreasing and increasing your hedge will be huge. So do this in moderation.

Stocks I’ve Hedged and Puts I Own

The biggest gains I’ve made on put options have been on Enviva (EVA) ($553,737) and Peloton Interactive (PTON) ($191,331). I currently own puts on sixteen stocks, and the ones I’m most hopeful for a complete collapse are Cibus (CBUS), Avid Bioservices (CDMO), Enovix (ENVX), Ivanhoe Electric (IE), NextDecade (NEXT), Sunnova Energy (NOVA), and EchoStar (SATS).

Returns of the Put-Option Hedge

Overall, I’ve lost 3% of my investment in put options. My realized trades have made 14.5%, but that isn’t high enough to offset my unrealized losses. However, unrealized losses present an unbalanced picture when it comes to medium-term options: realized returns are a far better indicator of their potential. The other reason for the imbalance is that I’m managing a whole lot more money now than I did in 2022 and 2023, and 2024 has not been a good year for hedging. I’ve seen a lot of unrealized underperformance before, and even a mild market correction will change that completely. The hedge has certainly smoothed my overall returns, which is its main function, and a return to profitability is in the cards as well.